Having a good tenant makes investing property so much better. However, even good tenants encounter financial loss and this will have a direct flow in effect to the landlord. On the other hand a bad tenant can cause significant problems to a landlord in more ways than one. Here are some ideas to help minimise rent in arrears: Upfront background checks When your property manager contacts you to present a...

Apartment

There is nothing worse than experiencing the loss of a life. If you know the person or not, nothing is more precious than life. However in this article we take a look at the financial perspective of a landlord’s interest in the event their tenant passes away. It’s the last thing any landlord wants to think about, but if you are investing in property for the long term, there is a possibility that a...

Depending on where mould in an investment property can be an issue all year round. In this article we explain some general points to help avoid the build up of mound in your investment property. What is mould? Mould and mildew are a form of funghi. They thrive and grow with built up moisture. Overtime a property may get damp, dark and poorly ventilated. This often occurs in wet areas of a home including...

The COVID-19 crisis has caused much pain to health, livelihoods and working careers. The situation has called for many changes in the way people interact. The real estate industry is set to experience many changes particularly in the way it presents a property inspection. Property inspections are traditionally conducted to show potential tenants a property to lease or potential buyers a property to...

Common mistakes buyers make - and how to avoid them. Buying a home is one of the biggest commitments you’ll make in a lifetime. If you can get it right the first time, you’ll obviously increase the chances of adding more properties to your net wealth. In doing so this article may help you prevent some common mistakes buyers make. You may also enjoy our article on "First Home Buyers - 5...

Buying off-the-plan is a great way to enter or introduce yourself into the property market. However, can you sell off the plan before settlement? As buyer's advocates we source many properties for buyers and help them settle in the best means possible. However, during the construction phase, some buyer's personal circumstances change. These are often unavoidable and can cause their finances to...

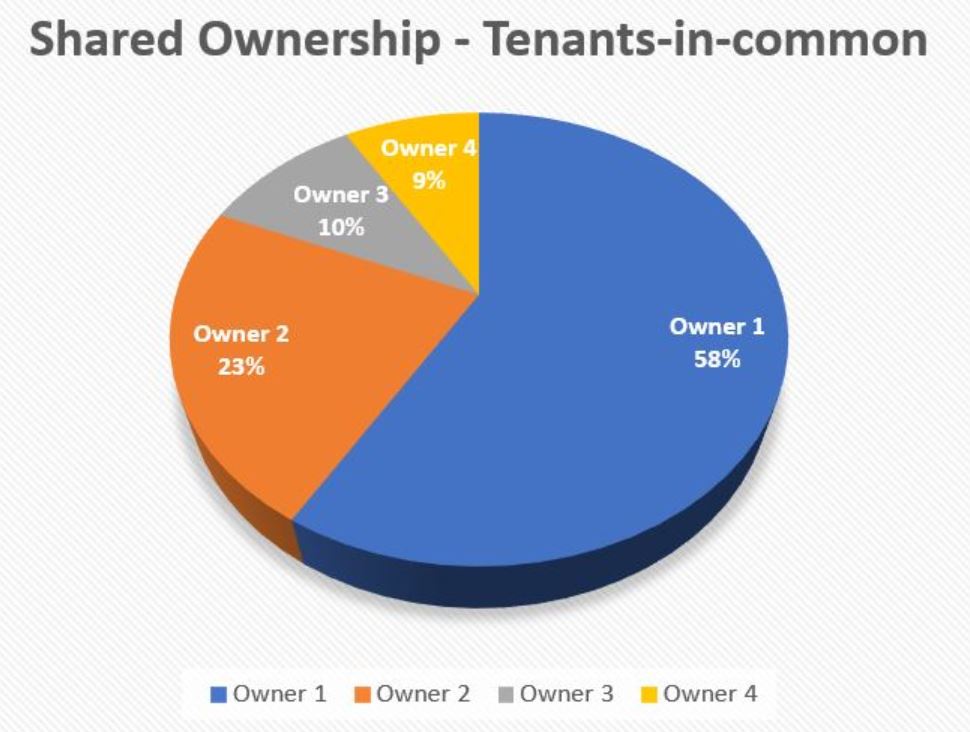

These days, not everybody wants to buy a property outright on their own. An alternative may be to purchase through a tenants in common. If you’re considering buying a house with a partner, however worried the relationship won’t last. The Tenants in Common Exchange (ticX) will provide you with a platform to sell your share. The ticX trading platform allows developers, builders, renovators and real...

How do valuers assess a property valuation? No matter if you purchase a brand new, off-the-plan or second-hand property, we are all in the mercy of the valuer. This is less relevant for a cash buyer, but for the most part, buyers require borrowed funds to complete their purchase. This means the bank will employ a valuer of their choice to complete property valuation. There are many professionals in...

Landlord insurance is an important means of protecting your investment property. Landlords' insurance is an insurance policy that covers a property owner from financial losses connected with rental properties. The most common landlord claims are tenant related issues over non-tenant related. According to EBM RentCover the majority of insurance claims were caused through tenant-related issues. The...

It is finally official. The Government has established a new policy called the mortgage guarantee scheme, which is aimed to help first home buyers enter the property market. The mortgage guarantee scheme will offer first home buyers the opportunity to purchase a property with just a 5% deposit subject to eligibility. The scheme will essentially boost up to 10,000 first home buyers each year on low and...