If you are unsure what a conveyancer is and what they do, here is a brief overview. What is conveyancing? When a property transaction takes place, the land ownership is transferred from one person or entity to another. Conveyancing is a legal process used to execute these transfers. Both buyers and sellers require a conveyancer or solicitor to guide them through the process. A conveyancer generally...

Lending

A good credit score demonstrates your financial health when it comes to lending. Without it, it's very difficult to get any form of loan, particularly a home mortgage. If you manage to obtain a loan, a bad credit score will result in paying an interest rate beyond the market average. Having a good score will provide better flexibility to source the right loan, while allowing you to access more money to...

Buying a home isn't easy and it generally requires you borrowing money to achieve this. In order to successfully obtain a loan, you need to place your financial circumstances in the best possible situation. While you don’t need to be debt-free to secure a mortgage, you still need to provide evidence that you are financial capable of borrowing money, maintain a financially responsible lifestyle can...

Most would assume that the Reserve Bank of Australia's (RBA) role is to announce the official cash rates. This is most certainly public knowledge where they announce it on the first Tuesday of 11 months of the year. However you'd be surprised how much responsibility the RBA has on our economy. The Reserve Bank of Australia (RBA) is Australia's central bank and derives its functions and powers from...

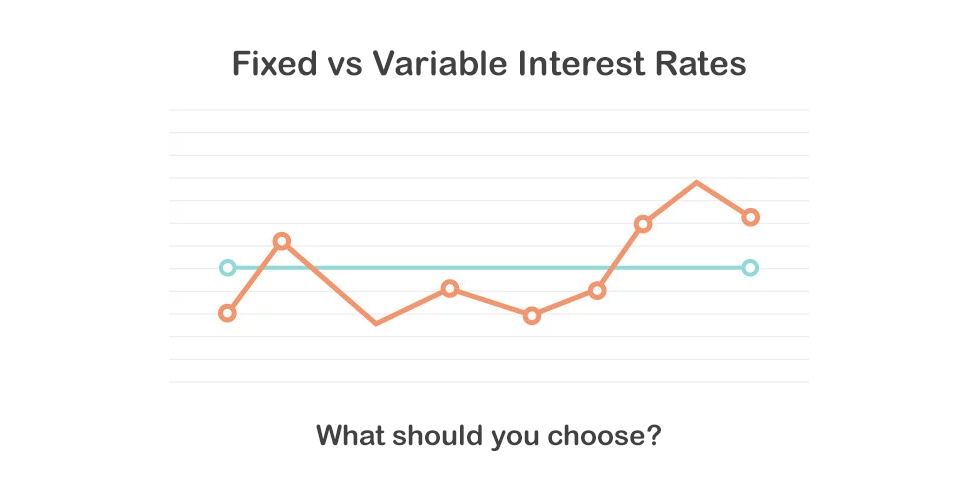

For people in the property market, a large consideration to work through prior to buying a property is which type of mortgage to apply for. Mortgage Choice published a useful article highlighting a hot topic in the current market. Do we lock in a fixed interest rate or do we ride out a variable interest rate? If this is you, you’ll need to carefully consider the following points. Obtaining lending...

According to the Australian Bureau of Statistics (ABS 3131.0 Dec 2018), the three major states of Australia being Sydney, Melbourne and Brisbane are witnessing over 300,000 new residents from overseas each year. This increasing population means that we need more property to house people. In view of the current economical commentary, there has been negative sentiment towards the property market. Some...

If you already have your home paid off or own an investment property, we dare say you are off to a great start! However many can fall complacent or become distracted with other important things such as work, raising a family etc… If you tick one of these boxes, perhaps it’s time for a financial review. We have helped many successful investors expand their property portfolio. In many cases we have...

What to look for when choosing a mortgage broker. A mortgage broker is a professional that arranges mortgages between borrowers and lenders. Consulting a professional mortgage broker can be an excellent contact in helping you accumulate a successful property portfolio. There is estimated to be over 16,000 mortgage brokers nationwide. How do you source the good ones? Here are four things to look for when...

Sometimes a lender will provide a cash substitute to the seller on the buyer's behalf, with the intention that the buyer will later pay the deposit for the property at settlement. This is known as a deposit bond. Why use a deposit bond? This can be advantageous for a buyer as it provides additional time to organise their finances before settlement. A Deposit Bond is generally a prompt way of arranging...

A loan pre-approval is the foundation of buying a property. One of the most important steps in the process of purchasing property is getting a loan pre-approval before you start seriously shopping. If it’s to occupy or invest, this is first step. So why obtain a loan pre-approval? A formal loan pre-approval from a lender provides you with a guideline to what you can spend. This is your maximum lending...