How to calculate rental yield. When buying an investment property, investors review the performance of their asset in three ways. These are income, capital growth and tax effectiveness. Understanding the rental yield is among the most important factor when considering a purchase. In this market insight we discuss what a rental yield is, how to calculate it and what is deemed a good return.

What is Rental Yield?

The rental income is often important as the income can be used to service the loan (if a loan was need to buy the property), provide an income stream in retirement (if debt free) and can hedge your overall investment return. If the property hasn’t witnessed capital growth over a shorter period of time, investors can still enjoy an income return through rent.

Rental yield v capital growth

When buying an investment property, investors want to see a combination of income and growth. Rental yield is not the only factor that determines whether a property is a good investment. Considering the prospect of capital growth is always desired as you may plan to sell it in the future to receive a profit. However, capital growth is not as regular or consistent. Successful property investors will aim to capture a combination on income and growth to stabilise the overall investment returns.

How to work out rental yield

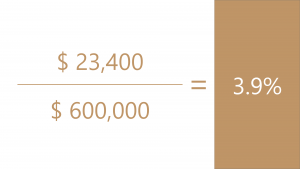

Calculating the rental yield of a property is far more simple than you realise. The formula used to calculate it is as follows:

When using this formula in an example. Let’s assume a property generates a weekly rent of $450, while its currently valued at $600,000.

What if I have an investment loan?

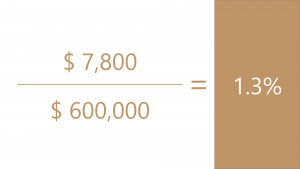

If you want to identify your rental yield with an investment loan, then you simply reduce the annual loan payments from the annual rental income. Most investors only take into account the loan interest expense and ignore the principle repayment. Taking the previous example, if the rent is $450 per week with loan payments being $300 per week, the net rental income would be $150 per week.

To annualise the rental income of $150 per week, multiply this figure by 52 weeks. This equates to $7,800 per year. Using the same formula as above you would be generating a rental yield of 1.3%.

What is a good rental yield?

Rental yields perform differently with each property type. Commercial property has a higher rental to residential, but the capital growth is lower.

In regards to residential property investments a rental yield of above 4% is seen as a very good return. The three main property types in residential are apartments, houses and townhouse/units. Apartments generally generate the highest followed by townhouses and houses. The more expensive a property, the harder it is to continue to increase the rent to match the capital growth. Houses and townhouse receiving a rental yield of 3% – 4% to be satisfactory.

When looking into rental returns and cash flow of a property, you should also consider other expenses such as council rates, property management fees, owners corporation fees (if any) and water rates to name a few. You may want to reduce these costs from your gross rental yield along with the loan payments to get a more accurate figure on cash flow. This will allow you to ascertain if you need to cover any ongoing from your own cash flow or not.

How do I work out the weekly rent?

When calculating the rental yield, you’ll first need to work out the weekly rent. Some of this can be figured out monitoring leases online, but we recommend speaking with a property manager who can provide a rental appraisal. The rental appraisal will be well resourced and can further be used when applying for an investment loan.

Does the rental yield take into account vacancies?

In short… no! When buying a property, there is a trade off between renting a property at market prices or pushing an above average return. If you can’t find a renter or you lose them, you can always potentially encounter a vacancy. When investing in property, you should always retain a cash buffer to cover an uncertainties such as paying a month’s loan payment as you have no renter or property maintenance.

If you’d like some assistance in calculating your gross and net rental yields, please feel free to contact us. We would welcome the opportunity to help.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more please contact us. We welcome the opportunity to assist you.

June 2021