Buying an investment property is a popular asset to own. Both new and experienced investors often have similar reasons why they wish to purchase an investment property. There are many advantages and disadvantages. Here were discuss and summarise them.

Advantages of purchasing an investment property:

- The property market is generally more stable than other investment markets such as the share market.

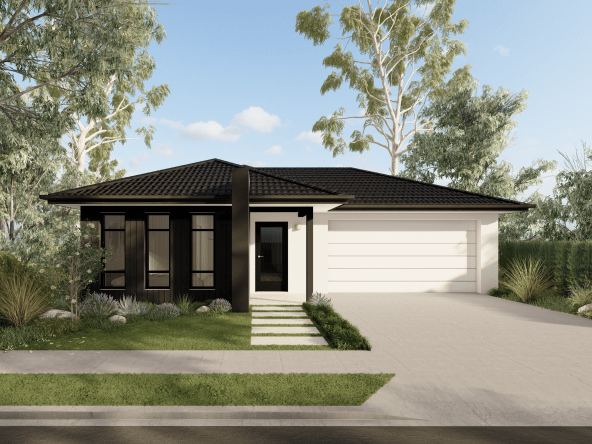

- It is a tangible asset. You can drive past and look at it when ever you want.

- You have good control over your asset. Selecting to buy or sell it, is up to you. You can also rent it to a tenant of your choice.

- An investment property generates a monthly income through rent. This is generally a fixed income when tenanted.

- The property value will increase over time offering you capital growth. The better the location, the better the capital growth.

- An investment property is entitled to many tax benefits. These include, tax depreciation, expenses paid on the investment property, such as property maintenance, council rates and property management fees to name a few.

- The interest charged on investment loans are generally tax deductible. Investors can use these tax deductions to pay less personal tax.

- Most property investors borrow funds to purchase an investment property. If the investor is entitled to borrowing money, banks will be more inclined to provide a substantial level of funds compared to buying assets in other investment markets.

- As the property increases in value, you may be able to use the equity to further invest. The equity doesn’t have to be only invested in real estate, but it would be secured to the investment property you have borrowed money against.

Disadvantages of purchasing an investment property:

- The initial costs to buy and sell an investment property are higher than other assets.

- Selling an investment property takes longer. This is particularly the case if it is still tenanted. Some buyers may be interested to own and occupy the property rather than continuing to lease it out.

- Rent is only received when it is tenanted. It can take time to lease which may result into no income for a certain period of time.

- Sourcing a tenant costs money. The cost of a property manager reducing your income.

- The property market generally increases over the long term, but it can experience a drop in value at different intervals. If you have borrowed funds, this can amplify the fluctuations.

- As it requires a lot of capital or money, it is difficult to diversify in other investment markets. This is because it often leaves little money left over to buy something else.

What should I do?

Buying an investment property has a proven track record to provide good returns in both income and growth over the long term. It is an asset class that is tangible, which provides better stability to most other investment markets. If you can afford to buy an investment property it can be a rewarding experience.

Before proceeding, it is important to note, it doesn’t come without risk. It also requires a substantial commitment, particularly if a loan is involved. It is ideal to obtain advice from a panel of professionals. An accountant will help you understand the tax benefits and mortgage broker will explain the interest costs and repayments. A financial planner will also help establish a budget ensuring you are able to implement the strategy while maintaining your lifestyle.

If you’d like to talk about your investment objectives, please don’t hesitate to contact us. We specialise in sourcing brand new and off the plan properties.

Our YouTube channel and Market Insights also provide a wealth of information to assist you with many areas relating to property.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more, please contact us. We welcome the opportunity to assist you.

August 2020