How does the property market impact inflation?

One of the biggest pressing economic circumstances right now in Australia is the impact of inflation.

According to the Australian Bureau of Statistics (ABS), Australia has reached the highest annual rate of inflation in June 2022 in almost 32 years. It was last recorded at 6.1%. The Reserve Bank of Australia (RBA) expect the annual inflation will peak at over 7%. This consequently means households will be finding it more difficult to meet their cost of living.

Inflation can also reduce the buying demand to purchase, including property purchases, but did you know the property market also contributes to the change to inflation.

How does the property market impact inflation?

- Rental income – Often only seen as an income stream, the rental market is in hot demand right now. This has reduced the supply of properties to rent (vacancy rates) and has flowed onto rental income going up. This is an income to a landlord, but it is an expense to a tenant. The increased rent has impacted in the rise of inflation.

- Utilities expenses – In order to occupy a property, we all need some form of gas, electricity and/or water. These expenses have dramatically increased in recent times and caused upward pressures on inflation.

- Building costs (brand new property) – Post the wake of covid-19 in 2020-2021 and even now, the global pandemic has limited supply of building materials. It has also reduced the supply of workers. Building costs have unfortunately increased and this has greatly contributed to the increased inflation rate.

- Rates – Both council and water rates are factored into this assessment rate. These have continued to rise and has also influenced higher inflation rates.

- Property repairs and maintenance – Both repairs and maintenance costs have increased. Based on the same reasons to the rising cost of building a new property, this is also a factor.

What the property market does not do to inflation?

- Purchasing land – You may think that building a new property on land must both be the one in the same. However, this is not the case. The land is not a factor considered in the rate of inflation. Land is considered an asset rather than seen as a consumable.

- Buying a second-hand property (existing home) – Another factor not contributed to this statistic is the buying/selling of an existing dwelling. The second-hand property market has witnessed unprecedent increased prices, but property transactions are within the real estate sector and not factored to the annual inflation rate.

- Interest rates on loans – Interest rate movements associated to the property market are also excluded from this statistic. Prior to 1998, it was reflected in the rate, but they determined that this made the assessment to difficult to review. It is no doubt a household expense for many Australians but its now a large contributing factor by the RBA to influence the inflation rate.

CoreLogic perspective on things

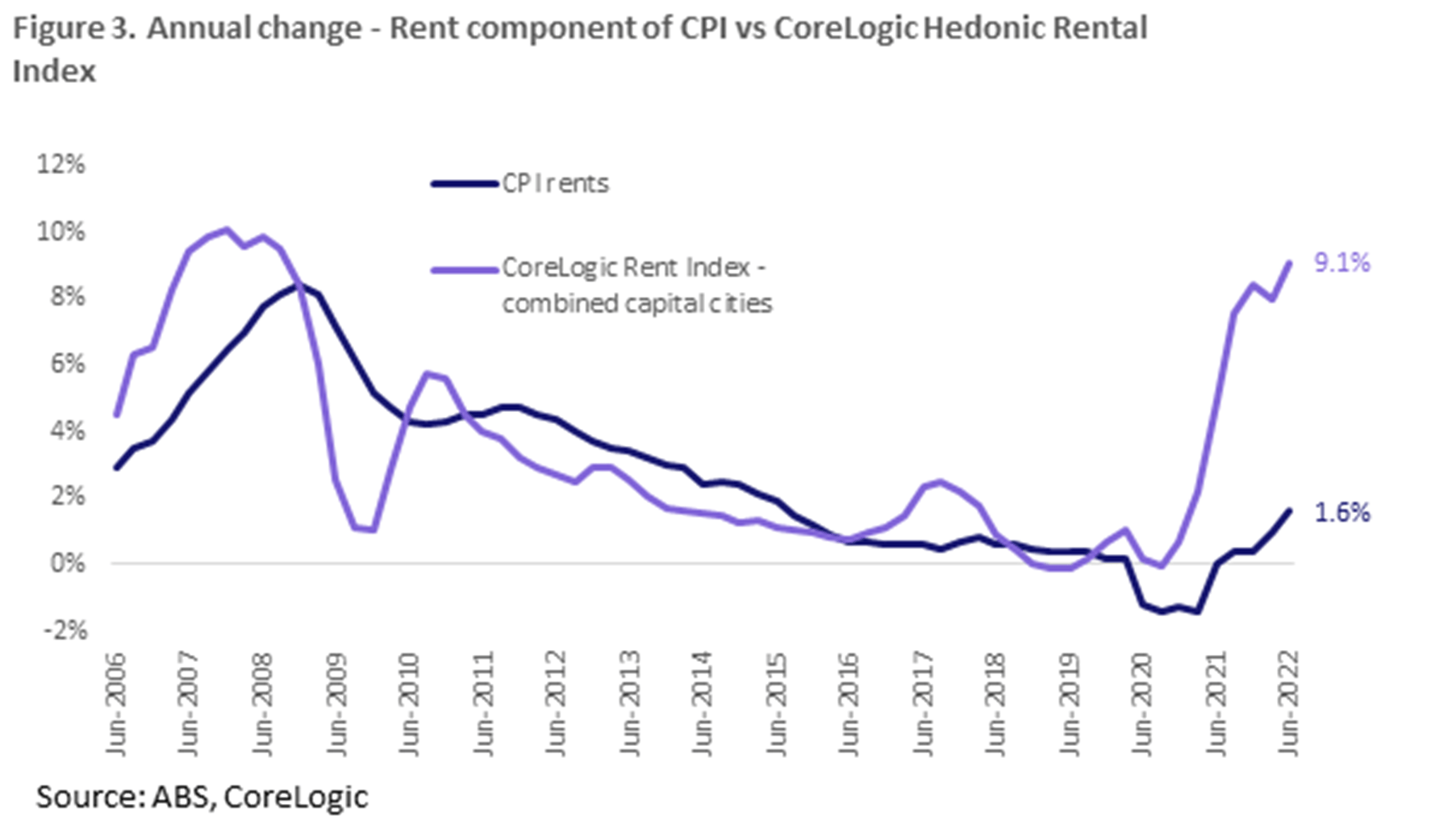

According to CoreLogic, there is currently a large discrepancy between the consumable price index measure of rents (CPI rent) and CoreLogic’s rent value index. This is because they measure two different things. CPI rents are measured from a sample of rental properties across private and government housing, to ascertain changes in rents actually paid. The CoreLogic series uses a hedonic regression model across all private dwellings to understand changes in rental valuations.

CoreLogic’s model typically leads trends in rents paid, because it is estimating value based on listings information. This is important because it can inform future movements in a heavily weighted component of inflation. If CoreLogic’s rent valuations are higher, this indicates households will be facing higher rents actually paid when they go to renew their lease. The fact that annual growth in CoreLogic rental values has shown no signs of slowing, suggests the rent component in inflation could also see further upward pressure in the coming quarters.

How long will it take reduce inflation back to the governments targeted levels?

Inflation is highly anticipated to remain high for the remainder of the year. The local and global economies are encountering many challenges from:

- The dispute/war between Russia’s invasion of Ukraine.

- The persistence of covid-19. There are new waves of the virus impacting lives around the world. China has again been economically restricted with new lockdowns.

- Australia nationwide has witnessed some extreme weather patterns, which have impacted many food lines, in particular produce.

No one has a blue crystal ball, but the recent public announcements by the RBA shows some potential signs that the inflation rate may start to moderate in early 2023. In the event this prediction is correct, it will also demonstrate trends the property market will find its new bottom platform in prices.

If you’d like to learn more about the property market, please don’t hesitate to contact us. Our YouTube channel and Market Insights also provide a wealth of information to assist you with many areas relating to property.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more please contact us. We welcome the opportunity to assist you.

August 2022