According to recent studies and research conducted by the Reserve Bank of Australia, Australians with mortgages have significantly increased their financial buffers in comparison to last year.

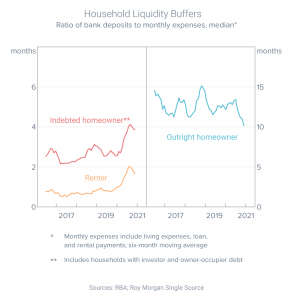

Taking note of the graph below, sourced by Roy Morgan, households are successfully increasing their household liquidity buffers. The left section indicates change within the indebted homeowners. They now have an average of four months worth of expenses in the bank. That compares to less than two months for renters and 10 months for people who own their home outright.

It is evident that during covid-19, many Australians were able to save. This was particularly acknowledged in Melbourne as residents endured months of home lockdowns. Many were simply unable to go out to socialize and spend money. The Reserve Bank of Australia confirmed that the average household doubled their savings rate last year to 12% of income. The additional savings were seen to be used to either creating financial buffers or reducing existing debt.

As we see many Australians improve their financial situation, we anticipate meeting new first time investors take the market as we move into 2021 and beyond.

If you are interested in looking to buy a brand new or off the plan property, we can help you through the entire process. We monitor the property market daily and will make sure you make the right investment decision.

While we have taken care to ensure the information above is true and correct at the time of publication, changes in circumstances and legislation after the displayed date may impact the accuracy of this article. If you want to learn more please contact us. We welcome the opportunity to assist you.

May 2021